Nvidia Warns of Gaming GPU Shortage This Quarter, Recovery Expected by Early 2025

Nvidia’s GPU Supply Challenges Loom Over Holiday Season Amid Record Profits and Blackwell GPU Launch Rumors

|

| (image credit: nvidia) |

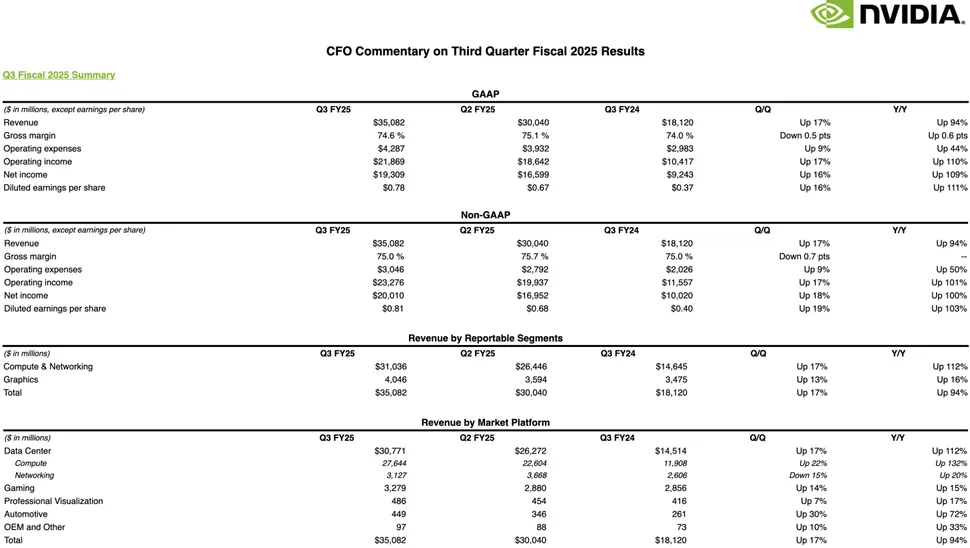

As the holiday season approaches, Nvidia’s latest earnings report showcases remarkable financial performance, but gamers seeking affordable GPUs might face supply issues. While Nvidia’s Q3 2024 revenue soared to $35 billion — a 94% year-over-year increase — CFO Colette Kress warned of potential supply shortfalls in the gaming GPU market this quarter, a crucial period for holiday shoppers.

A Stellar Quarter With a Cloud of Uncertainty

“Q3 was a great quarter for Gaming with notebook, console, and desktop revenue all growing sequentially and year-on-year,” said Kress during Nvidia’s earnings call. Gaming revenue reached $3.2 billion, a 15% increase from the previous year. Despite these gains, Kress highlighted concerns about meeting demand in the gaming segment.

“We expect fourth-quarter revenue to decline sequentially due to supply constraints,” she explained, adding that Nvidia is working to address the situation and anticipates a recovery in supply by early 2025.

The warning comes as Nvidia experiences unprecedented growth in its data center business, which contributed a staggering $30.7 billion to total revenue, accounting for 87.7% of its quarterly earnings. While this dominance in high-margin enterprise GPUs is a financial boon, it also highlights the challenges Nvidia faces in balancing production capacity between consumer gaming GPUs and the surging AI demand.

Reasons Behind the Supply Shortage

Several factors contribute to the potential GPU supply crunch:

1. Transition to Blackwell GPUs:

Nvidia is rumored to have scaled back production of its RTX 40-series GPUs to make way for the next-generation Blackwell RTX 50-series. The company is expected to launch its flagship RTX 5090 and 5080 models at CES 2025 in January, creating a temporary gap in consumer GPU availability.

2. High Demand for Existing Models:

Top-tier RTX 40-series models, such as the RTX 4090, are reportedly in short supply, with price hikes reflecting strong demand amid constrained production.

3. Data Center Priority:

Nvidia’s H100/H200 and Blackwell B100/B200 GPUs for AI and data centers are in exceptionally high demand, leading the company to allocate resources to this lucrative sector at the expense of gaming GPU production.

4. Holiday Season Surge:

The holiday shopping period traditionally drives increased demand for gaming hardware, which may exacerbate supply issues for Nvidia’s GPUs.

5. Limited Entry-Level Options:

With Nvidia focusing on high-end GPUs, entry-level and mid-range models remain scarce, a trend unlikely to change until later in 2025 when more affordable Blackwell GPUs are expected to arrive.

The Road to Blackwell: What to Expect

The upcoming Blackwell GPU lineup marks a significant technological leap for Nvidia. Leaks suggest that Nvidia has already started shipping chips to its add-in board (AIB) partners this quarter, though official confirmation remains elusive.

The CES 2025 event in January is expected to serve as the launchpad for the RTX 50-series, with Nvidia CEO Jensen Huang unveiling the RTX 5090 and 5080 models. However, the initial supply of these GPUs might be tight due to production bottlenecks, leaving consumers with limited options in the early months of 2025.

Interestingly, Nvidia plans to continue producing select RTX 40 mobile GPUs, which will be sold alongside their RTX 50 counterparts. This strategy could mitigate shortages in the laptop segment, ensuring some continuity for mobile gamers.

|

| (image credit: nvidia) |

Financial Highlights: Nvidia’s Record-Breaking Performance

Nvidia’s financial results reflect its dominance in both gaming and AI markets:

- Total Revenue: $35 billion, up 94% year-over-year.

- Net Income: $19.3 billion, a 109% increase compared to Q3 2023.

- Gaming Revenue: $3.2 billion, a 15% year-over-year increase despite potential supply issues.

- Data Center Revenue: $30.7 billion, driven by enterprise GPUs like the H100/H200 and Blackwell B100/B200.

These figures underscore Nvidia’s strategic pivot toward AI and data center markets, where demand continues to outstrip supply.

Impact on Gamers: What to Expect During the Holiday Season

For gamers and holiday shoppers, Nvidia’s supply constraints could lead to several challenges:

Higher Prices: Reduced RTX 40-series production and strong demand may drive up prices, particularly for popular models like the RTX 4090 and 4080.

Limited Availability: Gaming GPUs may be harder to find, especially during the peak shopping season.

No Entry-Level Blackwell GPUs: Affordable next-gen options are unlikely to launch before late 2025, leaving budget-conscious gamers with few alternatives.

Mobile GPU Availability: Laptop buyers may find more consistent availability as Nvidia continues producing RTX 40 mobile GPUs alongside RTX 50-series models.

Looking Ahead: Balancing Act for Nvidia

Nvidia’s ability to navigate these supply challenges will be crucial in the coming months. The company’s focus on clearing remaining Ada Lovelace (RTX 40) inventory at premium prices ahead of the Blackwell launch is a calculated move, but one that might leave consumers frustrated during the transition.

Gamers eager to upgrade their systems will need to weigh their options carefully: wait for the RTX 50-series or act quickly to secure an RTX 40 GPU before prices climb further. Meanwhile, the tech world eagerly awaits CES 2025, where Nvidia’s next-generation GPUs are expected to take center stage.

Are you holding out for the RTX 50-series, or will you grab an RTX 40 GPU before stocks run dry? Let us know your plans in the comments!

Comments

Post a Comment